Facts About Mileagewise - Reconstructing Mileage Logs Revealed

Table of ContentsAll About Mileagewise - Reconstructing Mileage LogsSome Known Details About Mileagewise - Reconstructing Mileage Logs The 7-Minute Rule for Mileagewise - Reconstructing Mileage LogsNot known Details About Mileagewise - Reconstructing Mileage Logs The Definitive Guide to Mileagewise - Reconstructing Mileage LogsThe Best Strategy To Use For Mileagewise - Reconstructing Mileage Logs

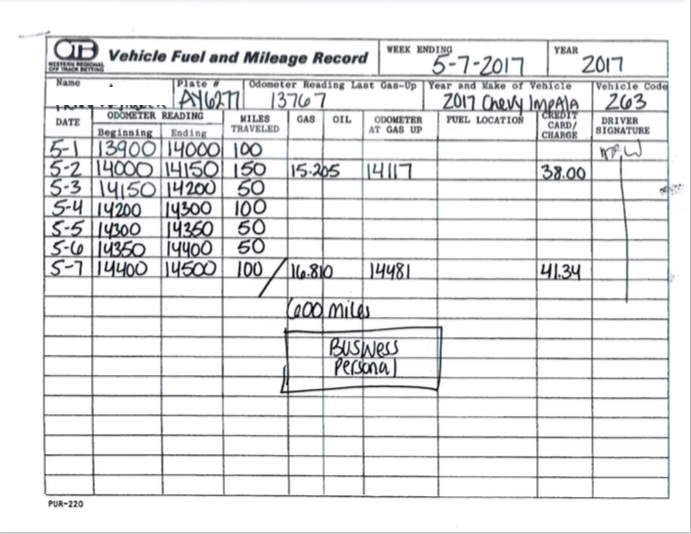

We'll study each better. Company gas mileage trackers are important to a cents-per-mile repayment program from a couple easy factors. Employees won't get their repayments unless they send mileage logs for their service journeys (free mileage tracker). Second, as previously stated, while by hand taping mileage is a choice, it's time consuming and reveals the company to mileage fraudulence.While a typical mileage repayment can be kept up hand-operated gas mileage monitoring, a FAVR program calls for a business mileage tracker. The reasoning is simple. FAVR reimbursements specify to each private driving worker. With the right provider, these rates are computed through a system that connects service gas mileage trackers with the data that guarantees fair and exact gas mileage compensation.

Ultimately, companies pay more and employees obtain less. Via an answerable allocation program, employees record and submit their gas mileage. This corroborates the allowance quantity they receive, ensuring any type of amount they obtain, as much as the internal revenue service mileage price, is untaxed. This likewise protects business from potential mileage audit threat. A company-provided automobile program, also described as a fleet program, can't possibly want a company gas mileage tracker, right? The company supplies staff members with cars they drive for organization trips.

Facts About Mileagewise - Reconstructing Mileage Logs Revealed

, "A worker's personal usage of an employer-owned car is thought about a part of a staff member's taxed earnings" So, what happens if the staff member doesn't keep a document of their service and personal miles?

A lot of organization mileage trackers will have a handful of these attributes. At the end of the day, it's one of the biggest benefits a business obtains when taking on a business mileage tracker.

An Unbiased View of Mileagewise - Reconstructing Mileage Logs

Mobile workers can include this info at any time prior to sending the gas mileage log. Or, if they tape-recorded an individual trip, they can eliminate it. Submitting gas mileage logs with a company gas mileage tracker ought to be a wind. Once all the info has actually find out here now been added appropriately, with the best tracker, a mobile employee can submit the mileage log from anywhere.

The Ultimate Guide To Mileagewise - Reconstructing Mileage Logs

Can you visualize if a service mileage tracker app recorded every solitary trip? Sometimes mobile employees just forget to transform them off. There's no damage in capturing individual trips. Those can conveniently be erased before entry. There's an also much easier service. With the very best gas mileage tracking application, companies can establish their working hours.

4 Easy Facts About Mileagewise - Reconstructing Mileage Logs Described

This app works hand in hand with the Motus platform to make sure the precision of each gas mileage log and reimbursement. Where does it stand in terms of the ideal mileage tracker?

Interested in finding out more regarding the Motus app? Take an excursion of our app today!.

Things about Mileagewise - Reconstructing Mileage Logs

We took each app to the field on a the same path during our rigorous screening. We evaluated every tracking setting and turned off the web mid-trip to try offline setting. Hands-on testing allowed us to take a look at functionality and identify if the application was simple or challenging for staff members to utilize.

: Easy to useAutomatic gas mileage trackingMinimum tracking rate thresholdSegmented tracking Easy to create timesheet reports and IRS-compliant gas mileage logsOffline mode: Advanced devices come as paid add-onsTimeero tops our checklist, many thanks to its ease of usage and the effectiveness with which it tracks gas mileage. You don't need to invest in pricey devices. Simply request staff members to set up the mobile application on their iOS or Android smartphones and that's it.

Comments on “The Main Principles Of Mileagewise - Reconstructing Mileage Logs”